Will the Baby Be Covered by This Insurance?

All major medical insurance plans today cover pregnancy. This coverage includes prenatal care, inpatient services, postnatal care, and newborn care. These essential services were put in place by the Affordable Care Act and help make it easier for both planning and expectant mothers to get insurance.

However, it's still important to understand how health insurance works concerning pregnancy since every pregnancy is different and will incur different costs.

If you don't have insurance and are pregnant, you may qualify for government health insurance programs, and if you don't, there may be free or discounted care options available to you in your area.

Does health insurance cover pregnancy?

All major medical/ACA health plans cover pregnancy and childbirth. Under the Affordable Care Act, pregnancy and maternity care are one of the ten essential health benefits that must be covered by health insurance plans offered to individuals, families, and small groups.

Health insurance for pregnancy, labor, delivery, and newborn care became mandatory in 2014 under the ACA.

Even if you don't have health insurance, there may be free or discounted services for expecting mothers in your area. There are also affordable options such as hospital indemnity policies; however, these may not cover as many pregnancy benefits like a major medical health insurance plan would.

What has changed about maternity coverage?

While all individual, family, and group plans must cover pregnancy, that wasn't always the case. Before the ACA, maternity coverage wasn't a guaranteed benefit. Before 2014 only around 12% of individual plans on the market listed pregnancy as a covered benefit, according to the National Women's Law Center. Only nine states required maternity coverage before 2014.

Maternity coverage was previously only offered by a limited number of plans or had to be added on as a special rider in addition to a plan. These riders also usually had a waiting period.

Additionally, before the ACA, pregnancy was considered a pre-existing condition, which meant insurers could decline or raise coverage prices for expecting mothers.

This meant that pre-2014 coverage could be denied or made more expensive to pregnant women by health insurance providers.

What services can I expect to be covered?

Maternity services covered by health plans include:

- Outpatient services – These services include prenatal and postnatal doctor visits, gestational diabetes screenings, lab studies, medications, etc.

- Inpatient services – such as hospitalization, physician fees, etc.

- Newborn baby care

- Lactation counseling and devices

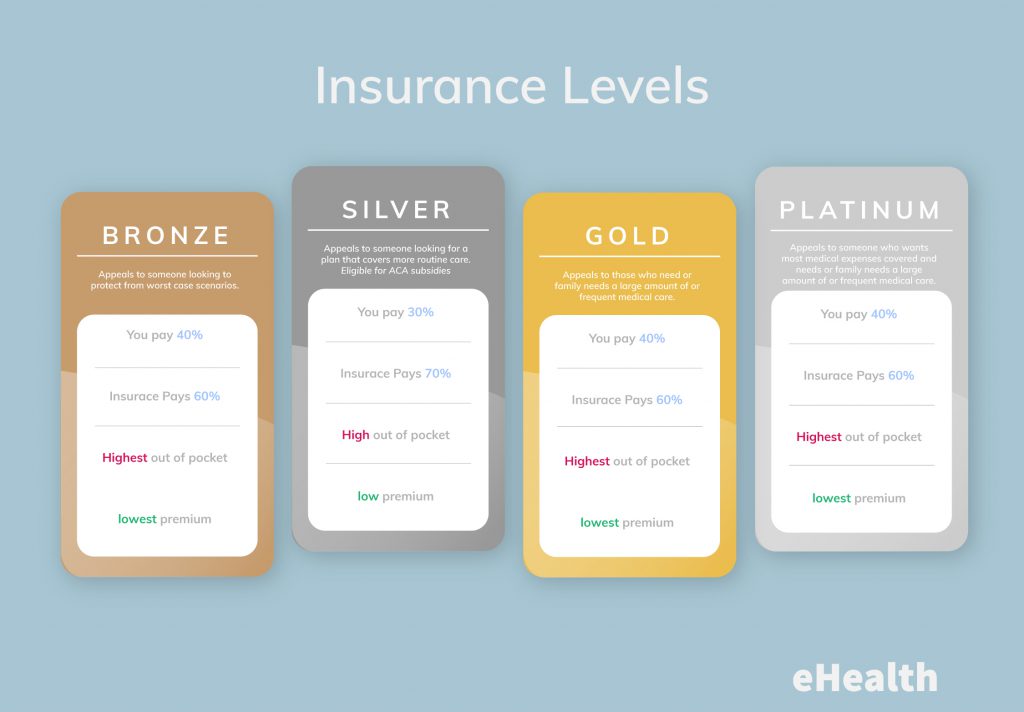

It's important to keep in mind that your coverage may vary depending on what plan you have since insurers can choose how they cover these benefits. Additionally, out-of-pocket costs are dependent on several factors, such as the metallic tier of coverage you have, deductibles, copayments, and which providers you choose.

How do I know what specific benefits are covered?

Health plans are required to provide a Summary of Benefits and Coverage documents. The summary will detail how each specific plan covers the cost of pregnancy and childbirth. If you are pregnant or plan on getting pregnant, review this Summary to see how your plan – or to compare how different plans – cover childbirth, this way you will know what to expect and are less likely to get any surprise medical bills.

Keep in mind that these services are covered by major medical plans even if you got pregnant before your coverage starts. Thanks to the ACA, pre-existing conditions are covered, this includes pregnancy.

It's also important to consider that if you have a grandfathered individual health plan – this is not the kind of plan you get through your employer, it's a plan you buy yourself – aren't required to cover pregnancy and childbirth. If you have a grandfathered individual health insurance plan, you may want to call your insurance company to learn about your plan's pregnancy and childbirth coverage.

If my doctor is in-network, my hospital is in-network, right?

Most people assume that since their doctor is covered by insurance that the hospital in which they're giving birth is also in-network. This is not always the case.

Just because an in-network doctor has privileges at a specific hospital doesn't make the hospital in-network. Additionally, neonatal intensive care units (NICUs) can be contracted by the hospital, which means they may be out-of-network. If your baby ends up going to the NICU and it so happens to be out-of-network, you can end up with surprise out-of-pocket expenses.

Similarly, if you choose to have an epidural, the anesthesiologist may not be in-network.

It's a good idea to call your insurance and make sure they cover the providers you plan to use before you give birth to make sure they're in-network and you don't get stuck with any expensive and unexpected medical bills.

Can you get or switch health insurance coverage while pregnant?

You can enroll in health insurance coverage during the annual open enrollment period, which runs from November 1st through December 15th in most states. Some states have extended open enrollment; to learn more about the open enrollment period in your state, check out our OEP by state breakdown.

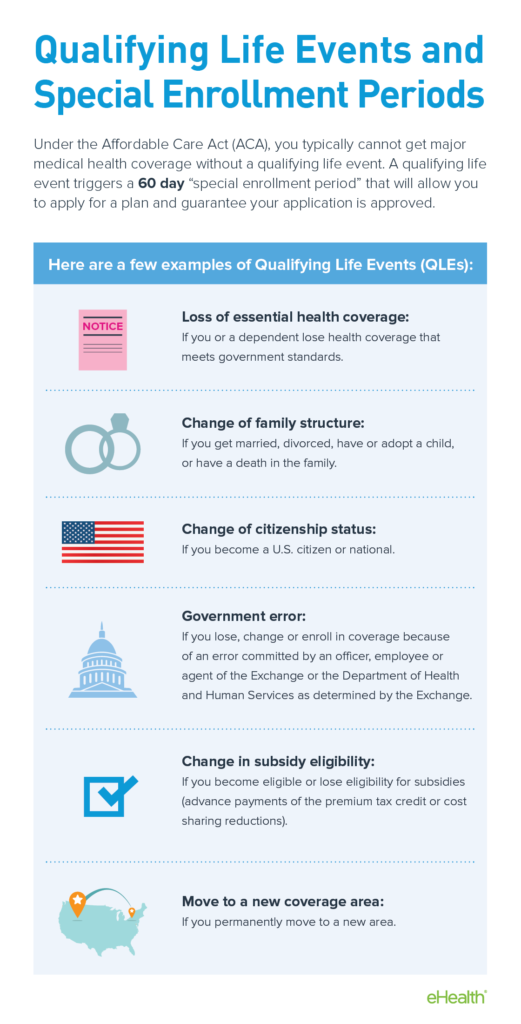

You cannot enroll or change health insurance plans outside of the open enrollment period unless you experience a qualifying life event. A qualifying life event will trigger a special enrollment period, which typically lasts around 60-days. During these 60 days, you may enroll or switch health insurance coverage.

While giving birth is a qualifying life event, becoming pregnant is not a qualifying life event.

This means that after you give birth, you will qualify for a special enrollment period. During these 60 days, you can enroll in a major medical health insurance plan, switch health insurance plans, or keep your current plan and add your child to your coverage.

What pregnancy benefits should you consider when looking at plans?

If you are pregnant or plan to become pregnant, some important things to consider about your current or any potential health insurance plan are:

- If you need a referral to see a specialist/OBGYN from your primary care physician

- The covered cost of labor and delivery

- Your copay, coinsurance, and deductible amounts

- If prenatal testing is covered – ultrasounds, amniocentesis, and genetic testing

- If you need to be preauthorized to receive prenatal care

- If non-traditional deliveries covered – midwives and home-births (some health insurance plans consider home deliveries 'not medically appropriate' and will not cover them, so make sure to check with your insurer if you plan on having a non-traditional birth).

- If private rooms are covered or if you will need to share a room during hospital delivery.

How much does it cost to give birth?

Prenatal care and giving birth is expensive – according to The Cost of Having a Baby in the United States, the average cost for a vaginal delivery was $32,093 and a cesarean section was $51,125 in 2013.

Additionally, the cost of giving birth varies greatly. For instance, Researchers at the University of California, San Francisco, in 2014, the cost of giving birth varied widely from $3,296 to $37,227 for an uncomplicated vaginal birth and $8,312 to almost $71,000 for a cesarean section.

Insurance typically covers a good portion of these expenses, but families may still need to be prepared to cover thousands in remaining costs. How much you pay out-of-pocket for coverage will vary depending on if you've met your deductible, if you have copays or co-insurances, if you've gone out-of-network, and other factors.

These are prices for births that go well. These averages do not include those who had complicated births or C-sections or if you or your baby requires an ICU or NICU stay. According to thebalance.com, if you have complications during a C-section, you could be looking at health insurance bills totaling to around $80,000.

Keep in mind that these prices do not include the cost of well-mother visits and tests, postnatal care, or newborn care.

Is pregnancy still considered a pre-existing condition?

Even though all ACA-compliant plans have to cover pre-natal services, birth, and infant care, pregnancy is still considered a pre-existing condition. While this is generally irrelevant when it comes to purchasing major medical insurance, it does matter when it comes to short-term health insurance.

Does short-term health insurance cover pregnancy?

Short-term health insurance is a great option for those who missed the open enrollment period, are looking for affordable coverage for worst-case scenario situations, and those looking to cover any other gaps in health insurance coverage.

Short-term insurance is cheaper, but these plans provide much less comprehensive coverage than major medical plans. Unlike ACA-compliant plans, short-term plans can also deny coverage if you have a pre-existing condition or refuse to cover care related to pre-existing conditions. Since pregnancy is still viewed as a pre-existing condition, short-term plans are very unlikely to cover care related to pregnancy or birth.

In a recent Kaiser Family Foundation (KFF) review of 24 short-term health insurance plans offered by two large online providers, none were found to cover maternity care.

Additionally, short term plans generally do not cover abortions – which typically cost under $1000 for procedures performed during the first trimester, which doesn't include the cost of travel and time off work which is an important factor for women who live in states where there is a mandatory waiting period to get an abortion.

While short-term plans are great options in other situations, they will not help offset the cost of pregnancy and giving birth.

What if I'm pregnant without health insurance?

If you are pregnant without health insurance, it is a wise decision to try to get health insurance coverage considering how expensive pregnancy and giving birth is.

If you haven't experienced a qualifying life event, you may qualify for Medicaid or the Children's Health Insurance Program (CHIP).

Pregnancy care and childbirth are both covered under Medicaid and CHIP. Unlike individual or family health insurance, there is no national open enrollment period for Medicaid or CHIP – which means you can enroll year-round if you qualify.

To qualify for Medicaid, you may have to meet an income requirement. Typically, those who have an annual income of 133% or below of the Federal Poverty Line (FPL) will qualify for Medicaid as they are considered "categorically needy."

However, due to expansions to Medicaid, women who are pregnant are more likely to qualify for coverage. This means that even if you were previously denied Medicaid based on income, you might qualify now that you are pregnant as you may be considered "medically needy."

Additionally, due to expansions to Medicaid, eligibility varies by state. If you find yourself pregnant and without health insurance, apply for Medicare even if you think you will not qualify.

What if I don't qualify for Medicaid but am pregnant and uninsured?

If you don't qualify for Medicaid or CHIP, there are still other ways for you to save money during your pregnancy and delivery.

For those who are in generally good health and expect an uncomplicated delivery, birth centers are a great option as they are typically less expensive than giving birth in a hospital ward.

Another option you may consider to help pay for the cost of your pregnancy and delivery are axillary insurance products – such as short-term disability insurance or hospital indemnity plans. These plans can help you off-set the cost of care and help make up for any time you spend out of work during your pregnancy, delivery, and after giving birth.

You also may be able to advocate for a lower price for your delivery with your hospital. Typically hospitals have a charity or self-pay rates for those who pay for care out of pocket.

You may be able to find free or low-cost maternity care in your area, depending on what resources you can find within your community. You may be able to find discounted or free care through Hill-Burton facilities or other charitable organizations, such as:

- Planned Parenthood

If you don't have insurance, your local Planned Parenthood center may be a valuable resource for maternal care and family planning. At some locations, not all, you can receive low-cost or free prenatal care.

Other family planning clinics also may be able to provide you with help during your pregnancy. - Public Health Departments

Your local public health department may provide maternity care. They do not provide insurance, but they may be able to provide you with care relating to your pregnancy if you meet an income requirement. - Community health centers.

Community health centers provide care to those with limited access to health care. They do not provide insurance options; however they can provide you with comprehensive prenatal care.

The fees for their services tend to be based on income level. - Charity care organizations

Some organizations provide services to help women with their pregnancy. Catholic Charities and Lutheran Services are two examples of these organizations.

The services offered at these charities may vary depending on location. However, services tend to range from free maternity care and postpartum care to lodging. - Hill-Burton Facilities

According to the Health Resources and Services Administration (HRSA), there are currently 132 (as of 8/2/2019) facilities that are obligated to provide free or low-cost healthcare since they've accepted grants or loans provided by the Hill-Burton act.

If you have a Hill-Burton Facility in your area, this may be a great resource for you to find free or low-cost care for you during your pregnancy or delivery. You do not have to be a citizen to qualify, though you will have to meet an income requirement.

According to the HRSA, there are no Hill-Burton obligated facilities in Alaska, Delaware, Indiana, Maryland, Minnesota, Nebraska, Nevada, North Dakota, Ohio, Rhode Island, South Dakota, Utah, Vermont, Wyoming, and all the territories apart from Puerto Rico.

Birth centers may save you money

If you're medically low risk, it may be worth looking into the possibility of giving birth in a birth center instead of a hospital. In an AABC study, birth centers were shown to be a safe place to give birth for medically-low risk women. Additionally, birth centers are significantly less expensive than giving birth in a hospital ward and have a high rate of patient satisfaction.

Birth centers are characterized by

- Having a relaxed and warm atmosphere

- The option to return home shortly after giving birth

- Providers that may include nurse-midwives, direct-entry midwives, or nurses working with an obstetrician

- Being a freestanding facility, on hospital grounds, or inside a hospital

According to Centsai.com, giving birth in a birth center costs around $12,000, whereas giving birth in hospital costs nearly three times that amount on average.

If you cannot get insurance while pregnant and are medically low-risk, it may be worth looking into giving birth in a birth center as opposed to a hospital to save money. According to the American Pregnancy Association, a birth center might not be the right fit for you if you are expecting twins, are diabetic or have preeclampsia.

Additionally, the American Pregnancy Organization recommends asking the following questions (and more) before choosing a birthing center:

- What is the transfer rate of women from the center to the hospital? (7-12% is acceptable)

- In what situations would labor be induced wither with Pitocin or by breaking the amniotic sac?

- Are analgesic drugs used? Are epidurals offered?

- Is there a time limit on the second stage of labor?

- What percent of their women require episiotomies? (less than 10% is normal)

For a longer list of questions, and more information on birthing centers, you can visit the American Pregnancy Organization's website.

Discount plans

One kind of insurance plan that you can get year-round to help cover the cost of your medical care is a discount plan.

These plans offer you discounts on certain health care services, prescriptions, and medical devices – like hearing aids, for example – from in-network providers.

These plans can help you save certain percentages on necessary services like prenatal and postpartum care.

These plans are a great low-cost option considering they can cost around $25-$45 per month and offer substantial discounts. For example, with AmeriaPlan's Deluxe Plus Membership, which is $39.95 per month, you can save up to 80% on wellness screenings, ancillary services, and they can help provide you with a bill negotiator to help you save on medical costs.

Hospital indemnity insurance

Another option for those without insurance is a hospital indemnity plan. These plans can help you prepare for the cost of labor and delivery.

These plans can also help pay for long term stays in the hospital. This coverage can especially be helpful if you or your baby need to be admitted into the ICU or NICU.

If you think that you may have a complicated delivery, hospital indemnity insurance may be appealing. They are a generally low-cost option considering hospital indemnity plans may pay up to $3,000 per admission (your admission and your child's admission are separate) while only costing around $45 per month.

Short-term and long-term disability coverage

Another way to help offset the cost of pregnancy and birth is to purchase short-term disability insurance. This type of coverage helps cover the time you're out of work while pregnant as well as during and post-delivery.

If you expect a complicated delivery or twins (or more), short-term or long-term disability coverage may be something you want to consider even though this type of coverage tends to be costly.

Short or long-term disability coverage can supply much-needed income during and after pregnancy. According to the Bureau of Labor Statistics, only around 15% of US workers in 2017 had family leave benefits – even though Federal law requires most employers to give workers 12 weeks of unpaid leave.

Most policies pay a six-week benefit for a vaginal birth and an eight-week benefit for a C-section. Most women have to stop working before delivery and some women need to take time off after giving birth because of complications like hypertension related to pregnancy and post-partum depression.

The cost of this type of coverage is a little more expensive as it tends to be a percentage of your annual gross income. You can expect to pay around 1-3% of your annual gross income for disability coverage. However, if you expect to be out of work for a long period, this may be an option to consider.

Self-pay and charity rates

Generally, hospitals offer lower rates to those who are medically needy or who pay for care in cash. They don't advertise these rates. You'll need to call and ask to find out about them.

It's common for hospitals to offer reduced fees for diagnostic procedures – such as x-rays and ultrasounds – as well as lab work.

If you expect to pay out-of-pocket for services through a hospital, call and ask if they have a self-pay or charity rate. If you are uninsured or have a high-deductible, you may be able to find significant savings by negotiating with your provider.

Getting affordable maternity health coverage

Since pregnancy and giving birth are mandatory health benefits under the ACA, getting affordable maternity health coverage is as simple as finding the right health insurance plan for you and your growing family.

You can start shopping for a health insurance plan that fits your budgetary and coverage needs at any point in the year. However, you can only enroll either during the annual open enrollment period – which runs from November 1st through December 15th in most states – or during a special enrollment period.

eHealth's intuitive site and license health insurance agents help you compare your health insurance plan options to help you find the plan that suits you best. Keep in mind that eHealth's help is completely free, you will not pay more for a plan purchased through eHealth than you would if you were to purchase it anywhere else. Additionally, eHealth's agents are always here to help you with questions even after you've purchased a plan.

Start shopping for plans available in your area by entering your zip code below.

Will the Baby Be Covered by This Insurance?

Source: https://www.ehealthinsurance.com/resources/guide/everything-you-need-to-know-about-health-insurance-and-pregnancy

0 Response to "Will the Baby Be Covered by This Insurance?"

Post a Comment